Junior Cash ISA

Save for your child’s future tax-free

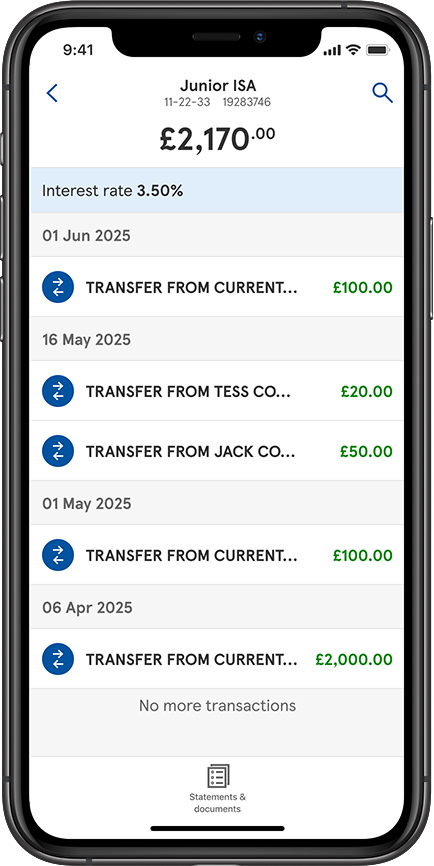

Anyone can make deposits anytime

3.50% Gross/AER (variable) interest

FSCS protected up to a total of £85,000

Why choose our Junior Cash ISA?

- Anyone with legal parental responsibility can open an account

If your child doesn’t already have a Child Trust Fund, you can open a Junior Cash ISA in their name. As the account belongs to the child, it won’t affect your own ISA allowance. - Family and friends can contribute

Birthday or Christmas money? Anyone can easily add to your child’s savings. - Start saving tax-free from just £1, or deposit a lump sum

Save as often or as little as you like, up to the £9000 Junior ISA limit for this tax year. This is the combined limit across all Junior ISAs held per child. The current rules for ISAs are subject to change by HM Revenue & Customs and the value of tax benefits depends on individual circumstances. - Transfer savings from other Junior ISAs

If you've been saving in another Junior ISA, you can transfer it to us. We'll make sure any money you’ve saved in previous tax years is moved without counting towards your Junior ISA limit for the current tax year - as long as you do this via the ISA Transfer Process. - Save with us, bank with anyone

Unlike some other banks, you don’t need to have an existing account with us. - Manage your money in our Mobile Banking App or Online Banking

Our friendly call centre staff are here too if you want to speak with someone. - Your money is FSCS protected

Your savings are protected up to a total of £85,000 per person across all Barclays and Tesco Bank accounts. - No withdrawals until your child turns 18

The money in the account belongs to your child and is saved for their future. While it can't be withdrawn, you can transfer it to another Junior ISA provider at any time.

*Rates shown in the Mobile App example are for illustrative purposes only.

Please read the Summary Box before moving on to apply.

A Summary Box sets out the key features of a savings account. It's designed to help you easily compare between accounts. For full details, please the account terms and conditions.

Summary Box:

Junior Cash ISA

3.50% Gross/AER* (variable)

Interest will be earned at a daily rate and applied to the account annually on the anniversary of account opening and at account closure.

*Gross is the interest rate paid before tax is deducted. Annual Equivalent Rate (AER) illustrates what the interest rate would be if paid and compounded each year.

- Yes – The account is a variable interest rate account so we may change the interest rate which applies to the account at any time. If we are going to reduce the interest rate we will always contact you in advance, with at least 14 days’ notice, by letter or email (depending on your statement preferences). The reasons which may lead us to reduce the interest rate can be found in the “Interest” section of your Terms and Conditions of the account and include, for example, changes in market conditions which affect interest rates.Yes – The account is a variable interest rate account so we may change the interest rate which applies to the account at any time. If we are going to reduce the interest rate we will always contact you in advance, with at least 14 days’ notice, by letter or email (depending on your statement preferences). The reasons which may lead us to reduce the interest rate can be found in the “Interest” section of your Terms and Conditions of the account and include, for example, changes in market conditions which affect interest rates.

- If we increase the Standard Interest Rate, the new rate can be viewed in Online Banking and we may also contact you to let you know.If we increase the Standard Interest Rate, the new rate can be viewed in Online Banking and we may also contact you to let you know.

The estimated balance would be £1,035.00.

Estimated balances are for illustrative purposes only and assume no further deposits, withdrawals or changes to the Standard Interest Rate during the 12 months.

A child can hold a Tesco Bank Junior Cash ISA if they:

- Are under 18 years of ageAre under 18 years of age

- Do not have a Child Trust Fund (unless the Child Trust Fund is being transferred into the Tesco Bank Junior Cash ISA on opening)Do not have a Child Trust Fund (unless the Child Trust Fund is being transferred into the Tesco Bank Junior Cash ISA on opening)

- Are resident in the UK, or are a Crown servant, a dependant of a Crown servant or married to or in a civil partnership with a Crown servantAre resident in the UK, or are a Crown servant, a dependant of a Crown servant or married to or in a civil partnership with a Crown servant

For more information about this, please contact HMRC.

Applying for the account:

- You can apply online and over the phoneYou can apply online and over the phone

- If the child is under 16, the application to open and manage the account must be made on their behalf by someone who has parental responsibility for themIf the child is under 16, the application to open and manage the account must be made on their behalf by someone who has parental responsibility for them

- The person who manages the account is known as the 'Registered Contact’The person who manages the account is known as the 'Registered Contact’

- If the child is over 16, they can apply to open and manage the account themselves by calling us on 0345 678 5678.* Please note that we are unable to accept online applications from children under 18If the child is over 16, they can apply to open and manage the account themselves by calling us on 0345 678 5678.* Please note that we are unable to accept online applications from children under 18

- To apply you must provide details of a Linked Account in your own name (the name of the Registered Contact where the child is under 16)To apply you must provide details of a Linked Account in your own name (the name of the Registered Contact where the child is under 16)

- You can deposit a minimum of £1, you don't need to make a minimum deposit on a regular basis and there is no maximum balance limit (subject to ISA subscription limits)You can deposit a minimum of £1, you don't need to make a minimum deposit on a regular basis and there is no maximum balance limit (subject to ISA subscription limits)

Managing the account:

- You can manage on the Mobile App, Online Banking and over the phone

*This number may be included as part of any inclusive minutes provided by your phone operator.

- No – the money in a Junior Cash ISA belongs to the child who can only withdraw it when he or she reaches age 18.No – the money in a Junior Cash ISA belongs to the child who can only withdraw it when he or she reaches age 18.

- No money can be withdrawn from the account until the child reaches age 18, but it can be transferred to another Junior ISA before the child reaches age 18.No money can be withdrawn from the account until the child reaches age 18, but it can be transferred to another Junior ISA before the child reaches age 18.

- In exceptional circumstances withdrawals may be allowed, for example, where the child is diagnosed with a terminal illness. We need permission from HMRC to do this. For more information about this please contact us.In exceptional circumstances withdrawals may be allowed, for example, where the child is diagnosed with a terminal illness. We need permission from HMRC to do this. For more information about this please contact us.

- The account can be cancelled within 30 days of receiving the welcome letterThe account can be cancelled within 30 days of receiving the welcome letter

- You can transfer a Junior ISA or Child Trust Fund from another ISA provider to your account, see the “Transferring a Junior ISA” section of your Terms and ConditionsYou can transfer a Junior ISA or Child Trust Fund from another ISA provider to your account, see the “Transferring a Junior ISA” section of your Terms and Conditions

- The child can apply to become the registered contact on the account when they reach 16 years oldThe child can apply to become the registered contact on the account when they reach 16 years old

- ISA rules are subject to change by HMRCISA rules are subject to change by HMRC

We know ISAs can be difficult to get your head around, so we’ve got some useful FAQs below to help understand how they work.

View or download the account documents

Frequently asked questions

A Junior Cash ISA is one of two ISA types on offer for children (Junior Cash ISA and Junior Stocks and Shares ISA).

Junior Cash ISAs allow you to save on behalf of your child without impacting your ISA limit. The money in the account belongs to them and can only be transferred to another Junior ISA in full, not withdrawn. When the child turns 18, they can access the money in their Junior ISA.

Please always check the rules of the account set out by the provider.

Anyone with legal parental responsibility for a child can open a Junior ISA. So if you're a parent or guardian of an eligible child, you can open a Junior Cash ISA for them.

When applying for the account you’ll need to provide details of a bank account in your own name to be the linked account.

Other people - grandparents, relatives and friends - can send money into your child’s account to add to their savings, as long as the combined savings in all your child's Junior ISAs don't exceed the limit of £9000 for this tax year.

A young person aged 16 or over can open an account themselves but they need to call us to apply. They can’t do it online.

There’s no limit to how much money can be in a Junior ISA, though there is a limit to how much you can pay in during each tax year. The tax year runs from 6 April to 5 April.

You can make as many deposits as you like into a Junior Cash ISA up to the total combined Junior ISA limit.

The combined amount that can be saved across all Junior ISAs held in your child’s name is £9000 for this tax year. This is on top of your personal ISA allowance, you can save up to the annual Junior ISA limit on behalf of your child.

For example, if you saved £5,000 into a Junior Cash ISA in this tax year, the maximum which can be saved into other types of Junior ISA in the same tax year is £4,000.

Remember, this is just for this tax year. If you’d like to transfer funds from previous tax years, then any amount can be transferred (via the ISA transfer process) without impacting your current tax year's ISA allowance - even if this exceeds £9000.

You can open and pay into only one Junior Cash ISA and one Junior Stocks and Shares ISA at any time. This is in addition to any other ISA accounts you hold.

This means if you have a Junior Cash ISA and want to open another, you’d need to transfer your full ISA balance to the new provider.

You can fund your account by:

Adding new deposits

- You can do this by sending money via your bank account. You’ll need the Cash ISA sort code and account number to do this. You’ll find this on your statement, your welcome letter or in Online Banking or the Mobile App.

- You can’t use this account for business transactions, make international payments or deposit income payments such as salary and pensions directly into the account.

Transferring funds from a previous or existing Junior ISA (via the ISA transfer process)

- We can transfer all, but not part, of the funds you’ve saved in an existing Junior Cash ISA without it contributing to this year’s Junior ISA limit. It's important not to withdraw and move the funds yourself, as doing so would lose its tax-free benefit and the transferred funds would contribute to your Junior ISA limit for the year. You can continue to add new deposits for the current tax year up to the combined Junior ISA limit of £9000.

- If you’re transferring a Junior Cash ISA to a Junior Stocks and Shares ISA, or vice versa, you can choose to transfer the balance in full or in part.

- To ensure your interest payments remain tax-free and the funds you transfer don’t contribute to this year’s tax-free Junior ISA limit, you need to transfer your funds using the ISA Transfer Process (this process is offered by Tesco Bank and most other providers).

If you don't have a Tesco Bank Junior Cash ISA you'll need to:

- Open a new account - you can do this online or by giving us a call.

- During the application you’ll be asked if you’d like to transfer from another ISA provider.

- If you choose this option we’ll include an ISA Transfer Form with your Welcome Pack.

- Return the ISA Transfer Form to us. We’ll handle the transfer with your current ISA provider on your behalf.

Once we receive your form, within 5 business days, we’ll ask your existing Cash ISA provider to arrange for your funds to be transferred to your Tesco Bank Cash ISA. Your provider will have 5 business days from receiving the request to do this and the transfer should be completed within 15 business days of us receiving your form.

We’ll start paying interest from the day your existing Cash ISA provider sends us your money or 16 business days after we receive your form (if this is earlier). Transfers from ISAs other than Cash ISAs may take up to 30 days.

If you already have a Tesco Bank Junior Cash ISA account and would like to transfer funds, you can:

- Complete a Junior ISA Transfer Authority Form and send it to us at the address shown on the form

- Call us on 0345 678 5678* to arrange this

*This number may be included as part of any inclusive call minutes provided by your phone operator.

If you wish to move some or all of the balance of your Tesco Bank Junior Cash ISA to another provider, please contact your new provider directly - they will arrange everything with us.

Protecting your savings

Your eligible deposits held by a UK establishment of Barclays Bank UK PLC are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. This limit is applied to the total of any deposits you have with the following: Barclays, Barclays Business Banking, Barclays Premier Banking, Barclays Wealth Management and Tesco Bank. Any total deposits you hold above the limit between these brands are unlikely to be covered.

Please ask for further information or visit www.fscs.org.uk.

Not the right account for you?

Are you an existing customer?

If you're an existing customer and are looking for some help, visit our Existing Customer page.

Tesco Bank is a trading name of Barclays Bank UK PLC. For more information on what this means please go to tescobank.com/transfer-scheme.