Fixed Rate Saver

Lock away your savings and guarantee your interest rate

Lock your interest rate for your chosen term

4.00% Gross/AER (fixed) for a 1 year term with interest paid annually - monthly interest options available

FSCS protected up to a total of £120,000

Why choose our Fixed Rate Saver?

- A guaranteed rate of up to 4.00% Gross/AER (fixed)

Your fixed rate is based on the term you choose and whether you want your interest paid monthly or annually, so you’ll know exactly how much your savings will grow. - Choose from a range of terms between 1 and 5 years

Save for a term that suits you, knowing your money is locked away to help you stay on track. - Get interest paid your way

Choose annual or monthly interest deposited into a separate account in your name to spend or save as you like. - Save from £2,000 to £5 million

You can make multiple deposits within the first 30 days of account opening. Your total balance must be at least £2,000 and no more than £5 million by the end of this period. After this time, no further deposits can be made. - Easy access at maturity

When your term ends have the freedom to withdraw or reinvest. - Save with us, bank with anyone

Unlike some other banks, you don’t need to have an existing account with us. - Manage your money in our Mobile Banking App or Online Banking

Our friendly call centre staff are here too if you want to speak with someone. - Your money is FSCS protected

Your savings are protected up to a total of £120,000 per person across all Barclays and Tesco Bank accounts. - You can’t make withdrawals during your chosen term

To make an early withdrawal you must contact us as this is only available in exceptional circumstances

|

Term |

Annual interest |

Monthly interest |

|---|---|---|

|

1 year |

4.00% |

3.93% |

|

15 months* |

4.05% |

3.98% |

|

18 months |

3.90% |

3.83% |

|

2 years |

3.85% |

3.78% |

|

3 years |

3.85% |

3.78% |

|

5 years |

3.90% |

3.83% |

All rates above are Gross/AER (fixed). Rates are subject to change and withdrawal at any time.

*Available to existing Fixed Rate Saver customers when reinvesting only.

Please read the Summary Box before moving on to apply.

A Summary Box sets out the key features of a savings account. It’s designed to help you easily compare between accounts. For full details, please read the account terms and conditions.

Summary Box:

Fixed Rate Saver

The interest depends on the term you choose and whether you choose annual or monthly interest.

|

Term |

Annual Interest Gross AER (fixed) |

Monthly Interest Gross AER (fixed) |

|---|---|---|

|

1 year |

4.00% |

3.93% |

|

15 months* |

4.05% |

3.98% |

|

18 months |

3.90% |

3.83% |

|

2 years |

3.85% |

3.78% |

|

3 years |

3.85% |

3.78% |

|

5 years |

3.90% |

3.83% |

*Available to existing Fixed Rate Saver customers when reinvesting only.

- You'll start earning interest from the day we receive the required minimum deposit. If we don't receive the required minimum deposit within 30 days of opening your account, or we need to return them to you, your account will be closed and no interest will be earned

- Interest will be paid directly to your Linked Account on the funding anniversary of the account. This will be monthly or annually, depending on what you choose at application

- Please note that if you fund your account by cheque, interest will be applied 2 Business Days after receipt

Gross is the interest paid before tax is deducted.

The Annual Equivalent Rate (AER) illustrates what the interest rate would be if paid and compounded each year. Interest on this account is paid directly into a separate account of your choice and is therefore not compounded.

No. The interest rate is fixed for your chosen term.

The balance of the account would not change as interest gets paid into the Linked Account.

Below shows the annual or monthly (Gross) interest payment that you would receive throughout your chosen fixed term, depending on which option you select. The monthly interest calculation is an average as this will vary depending on the number of days in the month:

|

Term |

Annual Interest option selected |

Monthly Interest option selected |

|---|---|---|

|

1 year |

£80.00 |

£6.55 |

|

15 months* |

£81.00 |

£6.63 |

|

18 months |

£78.00 |

£6.38 |

|

2 years |

£77.00 |

£6.30 |

|

3 years |

£77.00 |

£6.30 |

|

5 years |

£78.00 |

£6.38 |

*Available to existing Fixed Rate Saver customers when reinvesting only.

-

Apply or reinvest on our Mobile App, Online Banking or over the phone. To be eligible you must:

- Be a UK resident, or a Crown employee serving overseas

- Be aged 18 or over

- Be a UK resident, or a Crown employee serving overseas

- Be aged 18 or over

- Deposit a minimum of £2,000 up to a maximum of £5 millionDeposit a minimum of £2,000 up to a maximum of £5 million

-

You can:

- make multiple deposits within the first 30 days of opening a new account, or

- reinvest your balance plus any interest due, but you can’t make additional deposits

- make multiple deposits within the first 30 days of opening a new account, or

- reinvest your balance plus any interest due, but you can’t make additional deposits

- Manage your account and check your balance in our Mobile App, Online Banking or over the phone Manage your account and check your balance in our Mobile App, Online Banking or over the phone

- We’ll write to you before your maturity date to let you know your optionsWe’ll write to you before your maturity date to let you know your options

- No - you can’t take your money out until your fixed term ends. If you need to access your money due to exceptional circumstances, we will pay you the balance on your Account and the account will be closed. You will not be charged for this.No - you can’t take your money out until your fixed term ends. If you need to access your money due to exceptional circumstances, we will pay you the balance on your Account and the account will be closed. You will not be charged for this.

- The following examples are examples of what we consider ‘exceptional circumstances’ - death, diagnosis of terminal illness, bankruptcy, insolvency or sequestration. We may ask you to provide evidence of your circumstances. (House purchases are not considered exceptional circumstances).The following examples are examples of what we consider ‘exceptional circumstances’ - death, diagnosis of terminal illness, bankruptcy, insolvency or sequestration. We may ask you to provide evidence of your circumstances. (House purchases are not considered exceptional circumstances).

- We will send you a reminder at least 14 days before the end of your chosen term with options on what you can do with your money. If you don’t give us an instruction your money will stay in the account until you provide this. You will earn interest at a rate which we will inform you of before your fixed term ends.We will send you a reminder at least 14 days before the end of your chosen term with options on what you can do with your money. If you don’t give us an instruction your money will stay in the account until you provide this. You will earn interest at a rate which we will inform you of before your fixed term ends.

We won’t deduct tax from your interest – this will be paid gross. If you exceed your Personal Savings Allowance, you may need to pay tax on the interest you earn.

If you still have questions, we've got some useful FAQs below.

View or download the account documents

We’re updating our Terms and Conditions

From 12 March 2026, we’re making some changes to our Tesco Bank Savings Account Terms and Conditions. To help you understand what’s changing, just click the link below:

Frequently asked questions

Yes, you can open a joint Fixed Rate Saver with up to 2 account holders.

Eligible deposits in joint accounts are protected up to a total of £170,000 (£85,000 per person) by the Financial Services Compensation Scheme (FSCS).

Just so you know, if you have other individual or joint accounts with us, the £85,000 FSCS protection limit applies to the total deposits across these accounts, not to each account separately.

You can make multiple deposits within the first 30 days of account opening. Your total balance must be at least £2,000 and no more than £5 million by the end of this period. After this time, no further deposits can be made.

To send money from your bank account, you’ll need your Fixed Rate Saver sort code and account number – you’ll find this on your statement, your welcome pack or in Online Banking or the Mobile App. Different providers have different transfer limits, so it's essential to check these before making a payment.

Please note, if you have a joint account, you may need to wait up to 48 hours after account opening to send money via your bank account.

Depending on the term and interest option you choose, you may not have to wait for your fixed term to end to get your hands on your interest.

Choose to receive your interest annually or monthly and it’ll be sent to a separate bank account in your own name: this could be your current account, an ISA or any savings account you like - just check with your account provider to make sure they accept interest payments.

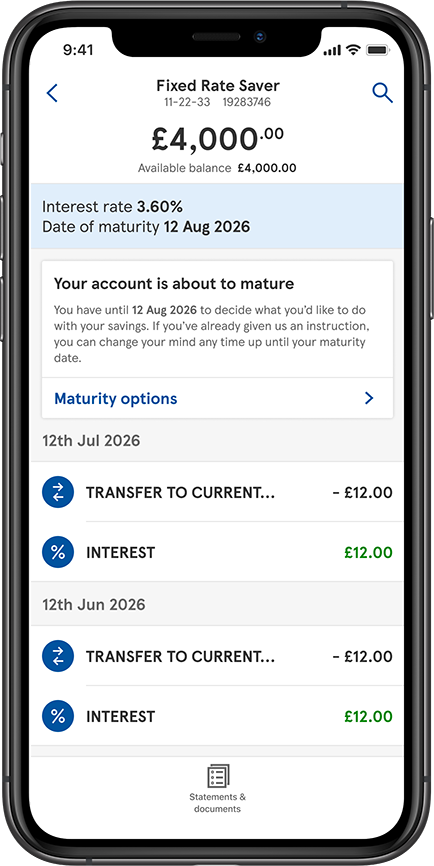

The easiest way to check your current interest rate is by logging into the Mobile Banking App or Online Banking, you’ll see your rate shown in the transaction list view.

If you want to see how your rate compares, or look back on what we’ve offered in the past 5 years, you can check the interest rate on your existing savings account.

As rates can vary depending on your product and when you opened it, checking both can help you understand how your rate has changed over time.

About 2 weeks before your Fixed Rate Saver matures, we’ll get in touch to ask you what you want to do with your money. You'll have the following options:

Reinvest your savings for another fixed term

Open a different type of savings account with us

Withdraw your money and close your account

You can visit our maturity page to learn more about these options.

If we don’t hear from you before your account matures, we’ll send the interest you’ve made to your linked account. After this, your account will begin to earn our standard variable rate.

Protecting your savings

Your eligible deposits held by a UK establishment of Barclays Bank UK PLC are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. This limit is applied to the total of any deposits you have with the following: Barclays, Barclays Business Banking, Barclays Premier Banking, Barclays Wealth Management and Tesco Bank. Any total deposits you hold above the limit between these brands are unlikely to be covered.

Please ask for further information or visit www.fscs.org.uk.

Please note: on 1 December 2025 the protection limit increased from £85,000 to £120,000. You might still see some reference to the old £85,000 limit while we update our materials, but rest assured your protection is now up to £120,000.

Not the right account for you?

Are you an existing customer?

If you're an existing customer and are looking for some help, visit our Existing Customer page.

Tesco Bank is a trading name of Barclays Bank UK PLC. For more information on what this means please go to tescobank.com/transfer-scheme.