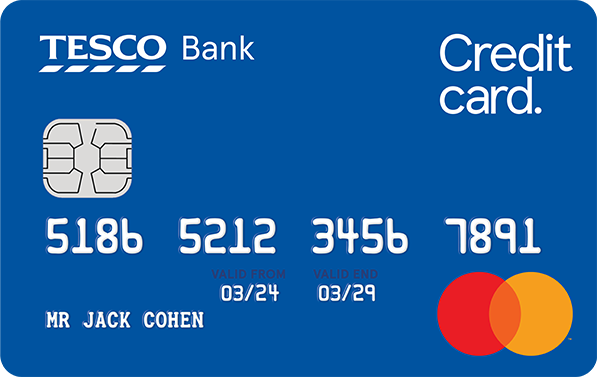

Foundation Credit Card

Help build your credit score and collect rewards with our credit card for bad credit

29.9%

APR

representative (variable)

Collect Clubcard points almost every time you spend in and out of Tesco

About this card

-

Are you new to credit or have a bad credit rating? If you’re looking to build or improve your credit score, our Foundation Credit Card could help.

What this card gives you

-

Starting credit limits between £200 - £1,500 and monthly repayments from £25

You may be considered for regular credit limit increases if you make your minimum payments on time, stay within your credit limit and similarly manage any other credit cards or loans you have with us.

-

Track your credit score

Get access to Tesco Bank CreditView, provided by TransUnion, for 3 years from account opening and track your credit score with monthly updates.

Credit card rewards

-

Collect extra Clubcard points with your Clubcard Credit Card

1 point for every £4 spent in Tesco

1 point for every £4 spent on Tesco fuel (excluding Esso) plus 1 point for every 2 litres bought

1 point for every £8 spent outside of Tesco

Points calculated on single transactions. Exclusions apply. Rates may vary. Find out more information on Credit Card Rewards.

-

Unlock Clubcard Prices

Did you know that you can use your Clubcard Credit Card to unlock Clubcard Prices? Watch your prices fall at the till, tap your credit card once to activate your Clubcard, and tap again to pay.

Good to know

-

Our Credit Card jargon buster

From APR to variable rates, the jargon that pops up when you apply for a credit card can be pretty confusing. Learn all the terms worth knowing with our quick-fire guide - you’ll be a credit card pro in no time.

-

Stay on track

You're more likely to see improvements in your credit score if you pay at least your minimum payment on time each month and stay within your credit limit.

-

Manage your card your way

It’s simple to manage your money on the go with our Mobile Banking App and Online Banking.

Representative example

Representative

29.9% APR

(variable)

Interest rate on purchases

29.9% p.a.

(variable)

Assumed credit limit

£1200

Your APR and credit limit may vary depending on your circumstances.

Tesco Bank Credit Cards are available to UK residents aged 18 and over. Subject to status.

Tesco Bank Credit Cards are provided by: Tesco Bank, PO Box 344, Newcastle Upon Tyne, NE12 2GF.

Tesco Bank is a trading name of Barclays Bank UK PLC. For more information on what this means please go to tescobank.com/transfer-scheme.