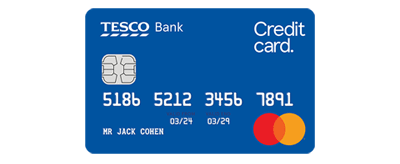

Help with your Clubcard Plus Credit Card

If you already have a Clubcard Plus Credit Card we are here to help from applying and managing your card to understanding your benefits and terms and conditions.

If you already have a Clubcard Plus Credit Card we are here to help from applying and managing your card to understanding your benefits and terms and conditions.

When you have Clubcard Plus, you can apply for our Clubcard Plus Credit Card.

Representative example

Since you need Clubcard Plus to benefit from this credit card, the 37.7% APR representative rate includes a variable purchase rate of 19.9% per annum and the £7.99 you already pay for your subscription. Rest assured, you won't need to pay an additional subscription fee for your credit card.

Whether you need help managing your card, reporting it lost or stolen or finding out about unrecognised transactions our credit card help page has lots of answers to common questions.

Your Clubcard Plus Credit Card is also your Clubcard. This means when you spend on it in Tesco you’ll collect your normal Clubcard points (1 point for every £1 spent) plus an extra 1 point for every £4 you spend. You will also collect 1 Clubcard point for every £8 spent outside of Tesco whether it’s online or on the high street.

Did you know you can use your Clubcard Plus Credit Card to unlock Clubcard Prices? Watch your prices fall at the till, tap your credit card once to activate your Clubcard, and tap again to pay.

You can turn your points into vouchers that you can use to save in Tesco, as well as on fuel at Tesco petrol stations and at Esso sites with a Tesco Express. You can also get 2x more value from your vouchers by exchanging them to use on days out, eating out and more with Tesco Reward Partners.

As a Clubcard Plus Credit Card customer, you won’t pay Foreign Exchange fees.

But remember, Cash Withdrawals (where you use the credit card at an ATM, over the counter at a bank or from a cash provider), will still incur fees.

There are some products at Tesco you won’t collect Clubcard points on. You can't collect points on tobacco or tobacco related products, lottery, stamps, prescription medicines, infant formulae milk, Tesco gift cards, third party gift cards, saving stamps, in-store concessions, Paypoint payments or for purchases of some Tesco Bank products.

Clubcard points also can’t be collected on some transactions including Travel Money, balance transfers and money transfers.

The Clubcard points collection rates apply to each purchase transaction and are subject to change.

You must have available credit on your card.

The Tesco Clubcard Scheme is administered by Tesco Stores Limited, Tesco House, Shire Park, Kestrel Way, Welwyn Garden City, AL7 1GA, who are responsible for fulfilling points.

If you cancel your Clubcard Plus subscription, we’ll start charging you Foreign Exchange fees of 2.75% on eligible transactions. We’ll give you at least 30 days’ notice before we do this. If you resume your Clubcard Plus subscription we’ll stop charging Foreign Exchange fees on all eligible transactions.

Head over to our FAQs to find answers to common queries, or if you need to speak to someone, our UK-based teams are here to talk seven days a week.

Tesco Bank Credit Cards are available to UK residents aged 18 and over. Subject to status.

Tesco Bank Credit Cards are provided by: Tesco Bank, PO Box 344 Newcastle Upon Tyne, NE12 2GF.