Help for existing Travel Insurance customers

Travel insurance claim

We're here to help if you have any issues while you're away, need to update your policy, make a claim or renew.

Travel insurance claim

Need emergency help whilst you're away?

If you need help in a medical emergency, you can call our emergency helpline which is open 24 hours a day, 7 days a week.

Your Insurance Account

We're here to help if you need to ask us a question, update your policy or would like to renew.

If you don’t want your policy to renew automatically:

Making a claim on our Travel Insurance

Gadget Cover claim

Our claims team are here to help you make a new claim or talk about an existing one.

If you purchased or renewed your policy on or after 13 December 2023, your appointed claims administrator is Taurus.

If you purchased your policy before 13 December 2023, your appointed claims administrator is Citymain.

Travel Insurance claim

You can make a claim online or give us a call. Please check your policy documents to find out what’s covered.

Car Hire Excess Insurance claim

Give us a call to make a claim on your Car Hire Excess additional cover. Lines are open Monday - Friday, 9am to 5pm.

Quick answers to common questions

Getting set up

Just applied for Travel Insurance? Here's what you might need to get started.

Managing your policy

Some of our commonly asked questions about Travel Insurance.

Something's not right

Not sure about something on your policy? We're here to help.

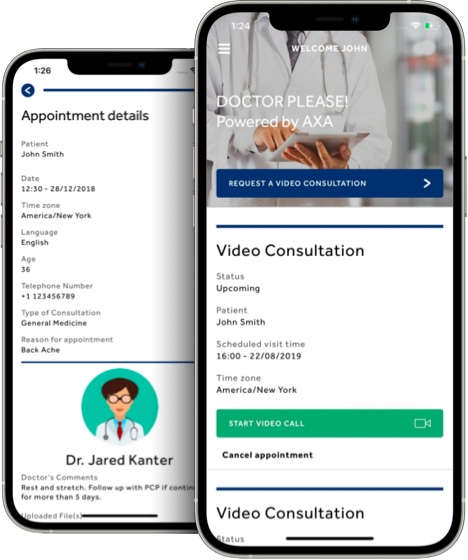

See a doctor virtually wherever you are

If you have a Single or Annual Multi Trip policy with Premier cover, a Backpacker or Later Life policy, you have access to the 'Doctor Please!' app to book online consultations. This service is provided by AXA (IPA). You'll find your access code in your welcome email or SMS. Alternatively you can call the team on the number below 24 hours a day, 7 days a week to book a consultation call.

What type of cover do you have?

How did you buy your policy?

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

So we can help you find your documents, please give us a call.

How did you buy your policy?

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

So we can help you find your documents, please give us a call.

How did you buy your policy?

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

So we can help you find your documents, please give us a call.

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of your cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

The Insurance Product Information Documents are a summary of the key features, benefits and exclusions of each cover level.

Policy Wording Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

So we can help you find your documents, please give us a call.

Important information

The Insurance Product Information Documents summarise the key features, benefits and exclusions of our additional cover.

Gadget cover is not available if you purchased from moneysupermarket.com

Gadget Cover Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

Car Hire Document

How we collect and use your personal data

Tesco Personal Finance PLC (trading as Tesco Bank) acts as an intermediary for this policy. Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A. Gadget Cover is underwritten by AmTrust Europe Limited (AmTrust). You can find out more about how ROCK will process and share your data in their Privacy Notice.

ROCK will share some of your information with Tesco Bank as set out in their privacy notice and you can find out more about how Tesco Bank will then process that data in our Privacy Policy.

ROCK will also share data with IPA UK so that they can underwrite your policy and if you make a claim. You can find out more about how IPA UK will process your data in the ‘Data Protection Notice and Fraud’ section of the Policy Wording document and by visiting the AXA Assistance website and AmTrust Europe website.

Top Travel Insurance FAQs

This is the part of the claim that you agree to pay per person. This is limited to two excess amounts per trip, even if more than two insured persons are claiming.

Excess amounts are detailed in your quote and in your policy booklet. You should check and be aware of these before you purchase.

All limits are per insured person.

Single Trip: The maximum duration of any one trip is 365 days.

Annual Multi Trip: 31 days per trip.

Backpacker Insurance: The maximum trip duration for any one trip is 550 days, you are covered for 3 return trips to the UK with a maximum duration of 31 days per trip.

Later Life: The maximum duration of any one trip is 15 days per policy. There is a 15-day maximum trip length for Winter Sports trips (if purchased).

If single trip cover is selected, you are only covered for trips which last up to or less than your maximum trip duration you selected (confirmed on your policy certificate).

Tesco Bank Travel Insurance doesn't cover mobile phones.

Optional Gadget Cover may be available to purchase at an additional cost.

Monetary limits, excesses and exclusions apply, for full details and eligibility please refer to your policy booklet.

You should also check if you have cover elsewhere, such as Home insurance or packaged bank accounts.

Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A. Gadget Cover is underwritten by AmTrust Europe Limited (AmTrust).

Yes, for all loss, theft or attempted theft claims you will be asked to provide a Police report including crime reference number or incident report, from the local Police in the country where the incident occurred.

Contact us - we're here to help

Have a question or need help applying? Our friendly, UK-based customer service team is here to help.